child tax credit 2021 portal

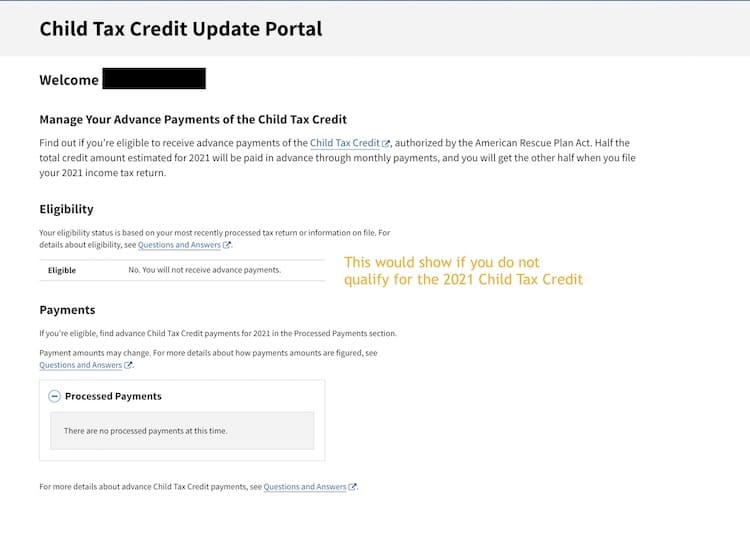

Families that did not receive monthly payments can still claim the full amount of the Child Tax Credit they are eligible for when they file taxes. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Get Set To Get Your Monthly Child Tax Credits By Clare Herceg Let S Get Set Medium

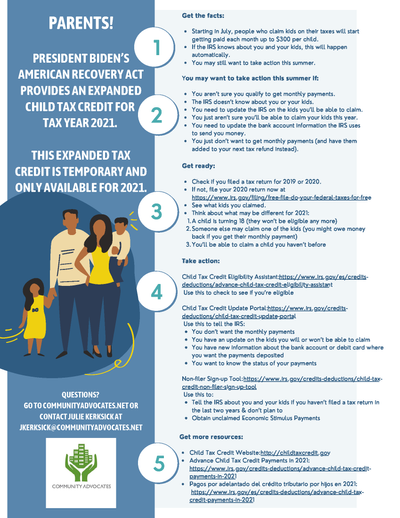

The American Rescue Plan Act which was passed in March 2021 temporarily expanded and enhanced the Child Tax Credit.

. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. Under a new law signed by President Biden on March 11 2021 individuals and families with children can get up to 300 per month per child under age 6 and up to 250 per month per. 3600 for children ages 5 and under at the end of 2021.

COVID Tax Tip 2021-101 July 14 2021. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and. IMPORTANT INFORMATION - the following tax types are now available in myconneCT.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. You can use your username and password for the Child Tax. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a.

It also provides the 3000 credit for 17-year-olds. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. 3000 for children ages 6 through 17 at.

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their. The expanded Child Tax Credit CTC for 2021 was a part of the American Rescue Plan Act ARPA signed into law by President Biden to get pandemic cash assistance to more families. Under the American Rescue Plan the IRS disbursed half of the.

Likewise if a 17-year-old turns 18 in 2021 the parents will receive 500 not 3000. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers. On July 15 2021 certain taxpayers will begin receiving the first.

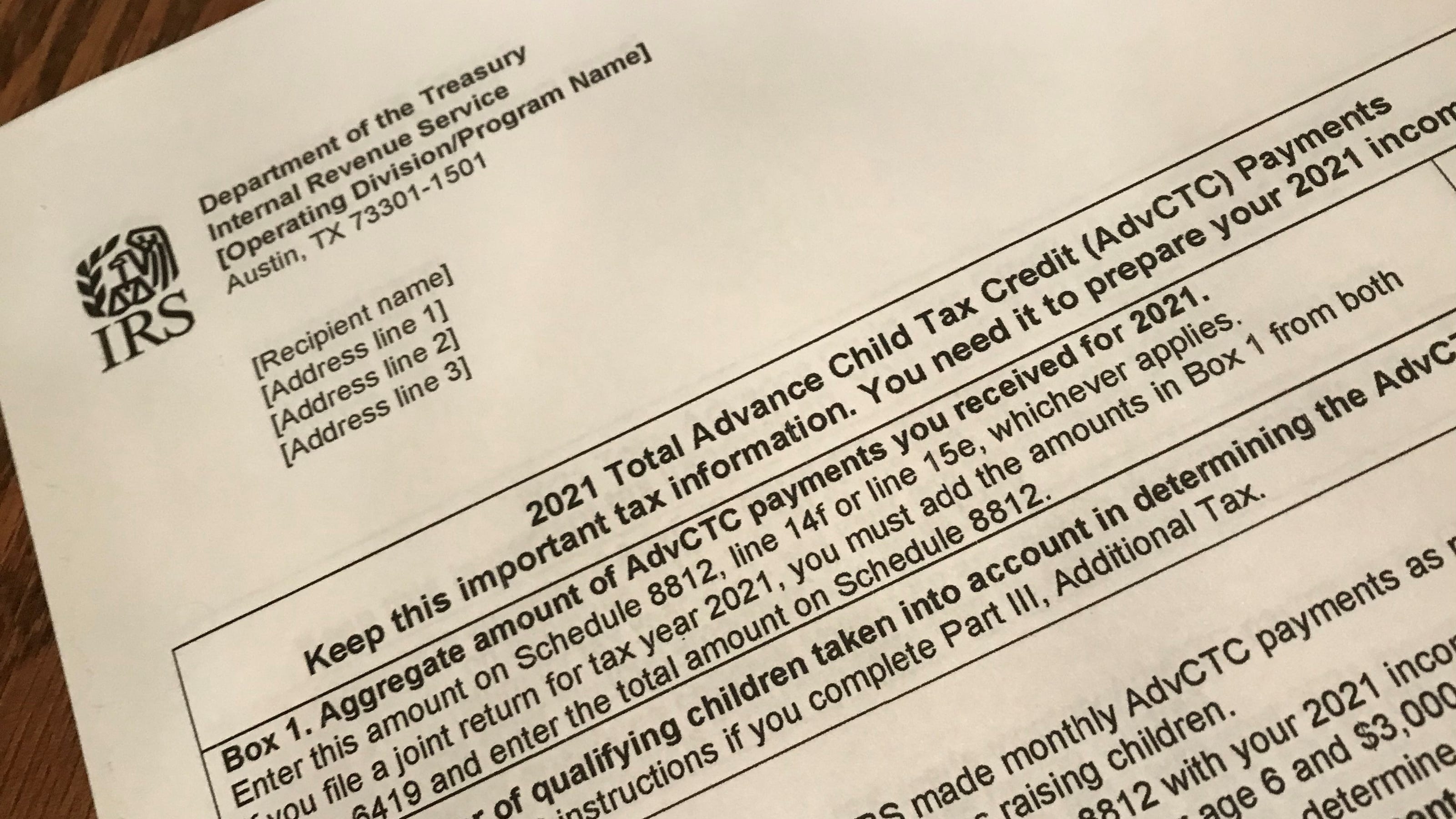

Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. 150000 if you are married and. Most families with no or low incomes can now claim.

Advance Child Tax Credit. Similarly for each child age 6 to 16 its increased from 2000 to 3000. 3000 for qualifying children between.

For tax year 2021 only ARPA increased the child tax credit amount to up to 3000 for each qualifying child between age 6 and 17 at the end of the 2021 tax year and 3600 for each. The amount of credit you receive is based on your. Individual Income Tax Attorney Occupational Tax Unified Gift and Estate Tax Controlling Interest.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. Why have monthly Child Tax Credit payments. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file.

Child tax credit payment schedule 2022as such the future of the child tax credit advance payments scheme remains. For 2021 the credit amount is. Families can still claim the full 2021 CTC or the half they are still owed if they received advance payments by filing tax returns this year.

If you are eligible for the Child Tax Credit but dont sign up for advance monthly payments by the November 15 deadline you can still claim the full credit of up to 3600 per child by filing.

American Rescue Plan Child Tax Credits Portal And Payments Fuoco Group

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Internal Revenue Service Launches Web Portal For Child Tax Credit Giving Non Filers Four Weeks To Declare Eligibility

Child Tax Credit What We Do Community Advocates

Child Tax Credit 2021 Update Parents Can Use Irs Portal To See Where Their 300 Is And Opt Out Of Payments The Us Sun

Child Tax Credit Portal How To Use The Irs Tool To Enroll For 2021 Nj Com

Child Tax Credit Cport Credit Union

Irs Adds Address Change Capability To Child Tax Credit Portal Nstp

Update Child Tax Credit Portal Now If Your Income Changed Forbes Advisor

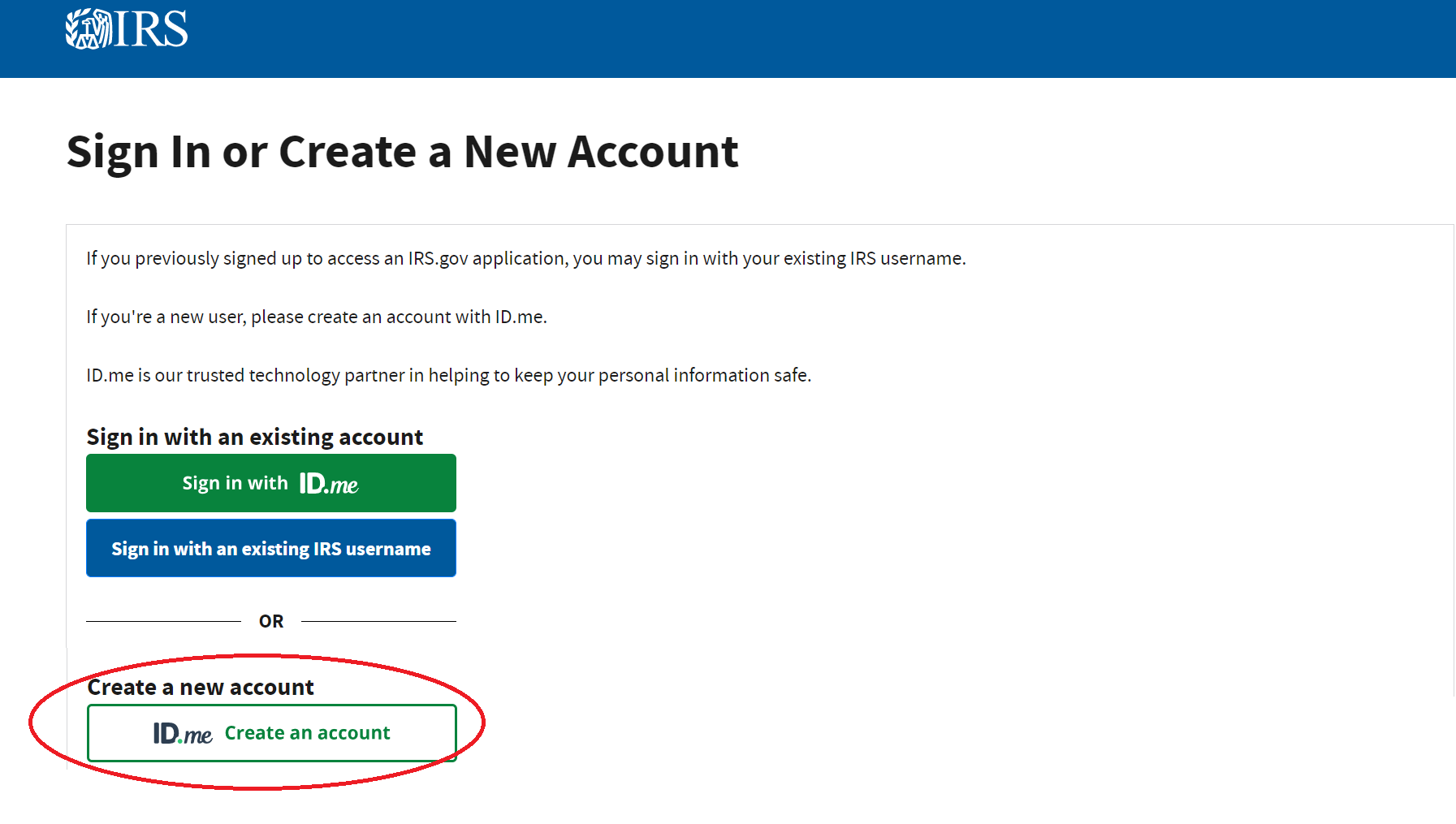

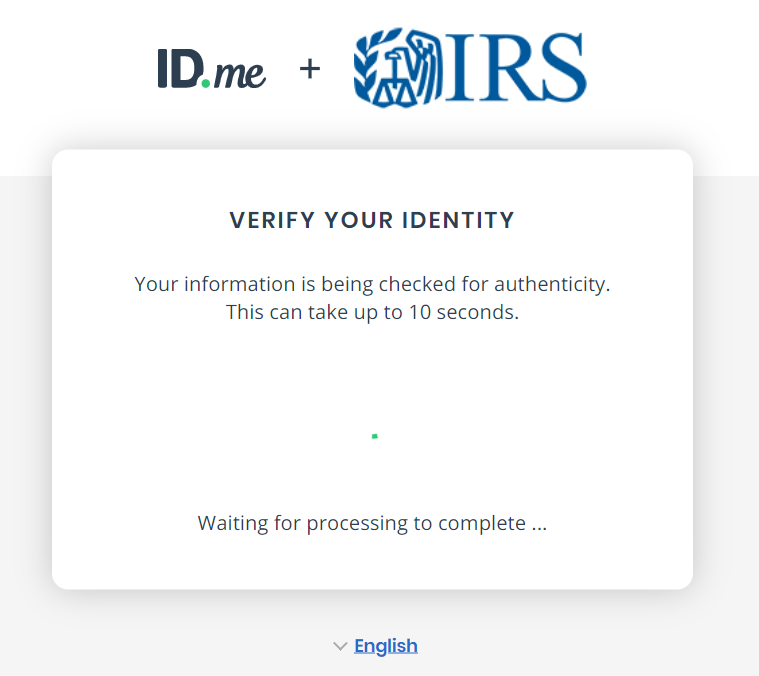

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit How To Claim It And File 2021 Taxes

Advancements In The Child Tax Credits Quality Back Office

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Ensuring Families Who Qualify For The Child Tax Credit Aren T Left Behind Code For America

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Accounting Aid Society Using The New Child Tax Credit Update Portal Families Can Now Unenroll From Advance Payments Meaning They Won T Get The Monthly Payments Set To Start July 15 And

H R Block On Twitter A Portion Of Your Child Tax Credit Payments Will Now Be Distributed Through Advance Payments If You Want To Opt Out Of These You Ll Need To Do So